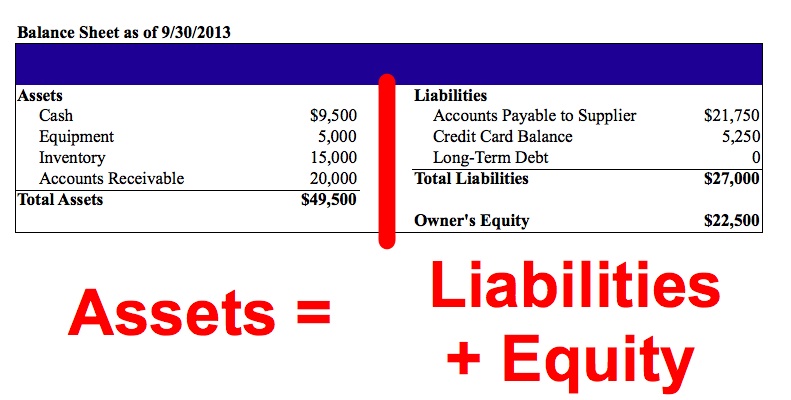

A balance sheet also commonly referred to as a statement of financial position is a statement of assets and liabilities of business enterprises at a particular date. This is Assets Liabilities Owners Equity.

At this point you can compute owners equity one of two ways.

Balance sheets for dummies. A balance sheet depicts the businesss assets and liabilities along with their respective values as at the end of an accounting period. Reading a balance sheet will help someone know how much asset a business owns and how much it owes to outsiders. A balance sheet is an indicator of the financial strength of a business.

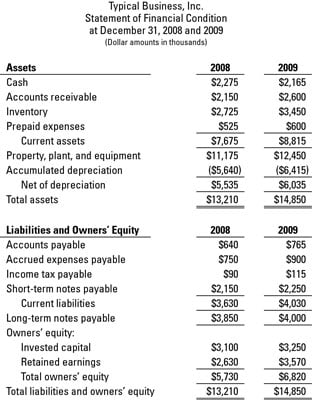

The balance sheet presents the balances amounts of a companys assets liabilities and owners equity at an instant in time. This example balance sheet discloses the original cost of the companys fixed assets and the accumulated depreciation recorded over the years since acquisition of the assets which is standard practice. A balance sheet is a financial statement that communicates the so-called book value of an organization as calculated by subtracting all of the companys liabilities and shareholder equity from its total assets.

The balance sheet equation is used to show what a company owns assets how much it owes liabilities and how much stake or share the owners have in the business shareholders equity. Its calculated with the following formula. Assets Liabilities Shareholders Equity.

A balance sheet is a financial snapshot that summarises the value of a business the assets of the business less its liabilities at a specific point in time. All limited companies have to prepare a balance sheet as part of the annual accounts they submit to Companies House but a balance sheet can be prepared at any time. Use the basic accounting equation to make a balance sheets.

This is Assets Liabilities Owners Equity. Thus a balance sheet has three sections. Assets which are the resources owned.

Liabilities which are the companys debts. And Owners Equity which is contributions by shareholders and the companys earnings. Lets go back to our universal balance sheet formula.

Assets Liabilities Owners Equity. Inserting our values we get. 250000 Assets 200000 Liabilities Owners Equity.

At this point you can compute owners equity one of two ways. You can either do some simple algebra and solve for the equity figure. A balance sheet is a financial statement at a given point in time.

It provides a snapshot summary of what a business owns or is owed - assets -and what it owes -liabilities -at a particular date. The balance sheet shows how the business is being funded and how those funds are being used. The balance sheet is used in three ways.

For reporting purposes as part of a limited companys annual accounts to help you and other interested parties such as investors creditors or shareholders to assess. A balance sheet also commonly referred to as a statement of financial position is a statement of assets and liabilities of business enterprises at a particular date. The balance sheet summarizes and reveals the financial position of an enterprise on a particular date by showing what is owns and what it owes.

Balance Sheet is the most important financial statement as it helps us see the financial position of the company at a given point in time. It is like a report card to measure a companys performance. Balance Sheet along with the Income Statement and the Cash Flow statement forms the three primary financial statements in accounting.

The balance sheet is divided into two parts that based on the following equation must equal each other or balance each other out. The main formula behind a balance sheet is. Balance Sheet Reconciliation is the reconciliation of the closing balances of all the accounts of the company that forms part of the companys balance sheet in order to ensure that the entries passed to derive the closing balances are recorded and classified properly so that balances in the balance sheet are appropriate.

A balance sheet is a financial statement included in company accounts. On this financial statement is included fixed assets current assets short term liabilities long-term liabilities provisions capital and reserves. A balance sheet is a set of numbers reported at a point in time which is usually at the end of a month or at the year end.

A balance sheet is a snapshot in time. Because of this snapshot nature its important to compare balance sheets with other balance sheets over time. In terms of reading the balance sheet there are a number of ratios that can be used to give business owners greater insight.

Debt to equity ratio total liabilities divided by total shareholder funds. What is a balance sheet and how can I read a balance sheet to learn more about the financial situation of a company. What do the various financial terms on.

Some terms that apply to balance sheets include. Assetsresources things owned and prepaid or deferred expenses. Examples include cash accounts receivable inventory prepaid insurance land equipment vehicles furnishings.

Please support us at. Balance sheets usually distinguish between short term assets usually less than a year old and called current and longer-term assets called non-current See p134 of the Travis Perkins annual.