And the returns below this amount are tax-free. Difference Between Hedge Fund vs Mutual Fund.

A hedge fund is an investment partnership which maintains a portfolio of investments to generate returns through advanced investment and risk management strategiesThe fund raises capital through private placement and pools the money of a few qualified wealthy investors along with the fund managers money.

Hedge fund vs mutual fund. A key difference between hedge funds and mutual funds is their redemption terms. Mutual fund investors can redeem their units on any given business day and receive the NAV net asset value of that. Hedge funds typically have much higher expenses than mutual funds.

For example hedge funds often have expenses that exceed 200 whereas most mutual funds have expenses that are 100 or below. Also hedge funds may also take a cut of the profits before passing them along to the investors. Difference Between Mutual Fund and Hedge Fund.

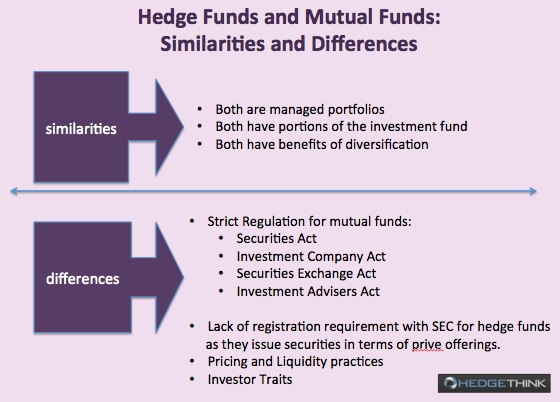

Both the mutual funds and the hedge funds are the investment funds where mutual funds are the funds which are available for the purpose of the investment to the public and are allowed for trading on the daily basis whereas in case of the hedge funds investments by only the accredited investors are allowed. Similarities and Differences. Liquidity is a very different between hedge funds and mutual funds.

With a mutual fund investors can sell shares one day and the sale. Difference Between Hedge Fund vs Mutual Fund. A hedge fund is an investment partnership which maintains a portfolio of investments to generate returns through advanced investment and risk management strategiesThe fund raises capital through private placement and pools the money of a few qualified wealthy investors along with the fund managers money.

Hedge funds are lightly regulated whereas mutual funds are strictly regulated by the Securities Exchange Board of India SEBI. The management fees depend on the percentage of assets managed in mutual funds. As opposed to hedge funds where the management fees are based on the performance of assets.

In hedge funds the fund manager also holds a substantial part of ownership. Unlike mutual funds where the fund manager does not hold substantial interest. Hedge Fund vs Mutual Fund.

The difference between Hedge fund and Mutual fund is that mutual funds will provide you with a minimum return rate that is known as the risk-free rate. On the other hand the hedge fund will try to maximize your return on your investment. Mutual funds have to declare their NAVs every day as Sebi regulations govern them.

This is an essential difference between hedge funds and mutual funds. A mutual fund distributes the entire investment amount into small units which are purchased by investors instead of directly investing in stocks and shares themselves. Hedge funds are also notoriously less regulated than mutual funds and other investment vehicles.

In terms of costs hedge funds are pricier to invest in than mutual funds or other investment. The Bottom Line Unlike mutual funds hedge fund managers actively manage investment portfolios with a goal of absolute returns regardless of the overall market or index movements. But how do you decide between exchange-traded funds and mutual fundsThe truth is that ETFs and mutual funds have a lot in common.

There are several key differences however that could make one a. In mutual funds you can get expert management of funds and maintenance at a relatively lower rate. The highest limit for expense ratio is 105.

ULIPs might invite a much higher cost when compared to mutual funds. Switching between funds after a certain threshold might invite a charge of 100 to 500. In case of equity mutual funds one has to pay tax if the gains are more than Rs 1 lakh in one financial year.

10 percent long-term capital gains LTCG is charged on the gains over Rs 1 lakh. And the returns below this amount are tax-free. Meanwhile the Debt Mutual Fund returns for less than three years are considered as short-term capital.

A hedge funds investment universe is only limited by its mandate. A hedge fund can basically invest in anythingland real estate stocks derivatives and currencies. Mutual funds by contrast.

Investing in a mutual fund a collection of investment assets packaged as a single security can be a great way to get exposure to the stock market bonds and other types of asset classes. Mutual funds will help him diversify easily with a very small investment. In mutual funds a dedicated fund manager who understands the Indian markets actively monitors and oversees fund so that inexperienced investors dont have to sweat it out.

MFs make it easy for rookie investors to follow a disciplined way of investing. Mutual Funds Vs ETFs. Similarities Differences in 2021.

February 12 2021. On one level both mutual funds and ETFs do the same thing. Lets imagine for instance two products that are designed to track the SP 500.

An ETF and a mutual fund.