If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government. 7000 at06 percent FUTA tax equals 42.

7000 at06 percent FUTA tax equals 42.

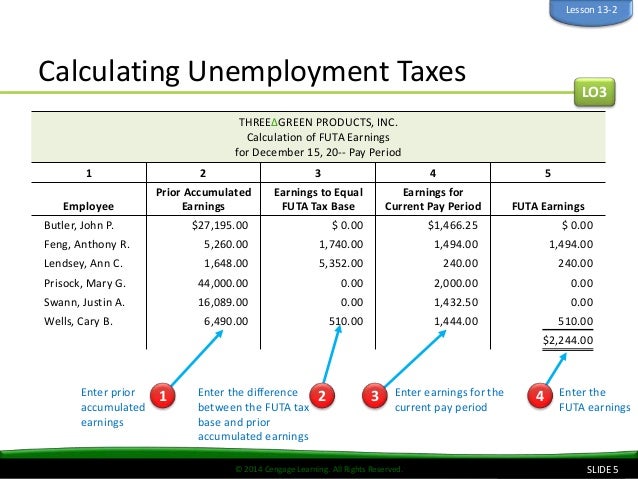

How to calculate futa tax. To calculate your businesss FUTA tax liability determine your employees wages subject to FUTA tax. Start with their gross pay their total salary or wages before deductions and taxes and. At this moment you should multiply the taxable amount by 54 percent which is the maximum limit of availing a tax credit.

7 Now you should calculate your net FUTA tax. To calculate this you will have to subtract your SUTA tax amount from the base FUTA tax and the result will be your net FUTA tax. For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income.

The federal FUTA is the same for all employers 60 percent. Heres how you calculate the FUTA tax for this company. 8000 x 0027 216 per employee.

216 x 10 employees 2160. Your FUTA tax liability after the credit will be 06 of the first 7000 each employee earns. Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario.

Add up the wages paid during the reporting period to your employees who are subject to FUTA tax. In order to determine the total amount subject to the FUTA tax simply subtract the subtotal from the total amount of payments made to your employees. In the example above this would result in a total taxable amount of 18500 103000-84500 18500.

Employers can typically claim the full credit as long as their unemployment taxes are paid in full and on time. If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government. But theres another way your location can impact your tax rate.

Assuming youre eligible for the full credit which will make you pay only 06 percent FUTA tax here is how your calculator is going to work. 7000 at06 percent FUTA tax equals 42. FUCA tax is paid for every quarter.

If you owe 42 for a single employee it must be paid by the end of the following month after the quarter ends. I am trying to calculate the unemployment tax for each budgeted employee by month. What I need the spread sheet to do is to calculate FUTA Fed Unemployment Tax.

The rate is 005125 for the 1st 8000 dollar earned. After an employee accummulatively earns more than 8000 heshe does not need to be taxed any more. Calculating FUTA Taxes If you are subject to FUTA tax you must pay the current rate for up to the first 7000 in wages for each employee.

You must calculate the tax due on each employees wages. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised of a 62 tax minus a 54 credit. Thus the maximum amount of FUTA that an employer can pay per year for each employee is 56 7000 x 0008.

If you paid wages subject to state unemployment tax you may receive a credit when you file your Form 940. The credit maximum is 54. If you are entitled to such a credit your final FUTA tax rate would be the standard FUTA tax rate of 60 minus the credit.

The standard FUTA tax rate is 6 on the first 7000 of an employees wages subject to FUTA tax. This 6 is then reduced by up to 54 to give a credit to the state where you do business for the states unemployment taxes. So the federal FUTA tax after the credit is applied is 06.

The net FUTA tax rate will be 06 percent effective January 1 2008. Payroll challenges eased by software solutions. How to compute FUTA tax liability Although the FUTA tax is reported annually the FUTA tax liability is calculated quarterly for the first three quarters of each year for deposit purposes.

The Federal Unemployment Tax Act known as FUTA refers to a payroll tax that employers pay on an annual or quarterly basis toward unemployment compensation for employees who have lost their jobs. This tax is also known as FUTA Liability tax. The FUTA tax rate is 60 of the first 700000 of an employees wages during the year.

If some of the Taxable FUTA wages you paid were excluded from State Unemployment Tax. If you paid any State Unemployment Tax late after January 31st For ease of calculation IRS has provided worksheet to calculate the credit amount that is to be filled on Line 10 of Form 940. The FUTA Federal Unemployment Tax Act tax is a tax which is every employer is liable to pay for all of the employees.

This tax serves as an employers compensation to those who have lost their jobs. So if you want to know how to calculate the FUTA taxes then this is how you do it. Got to the official website of IRS.

The FUTA tax is 6 0060 on the first 7000 of income for each employee. Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable state unemployment tax. Consequently the effective rate works out to 06 0006.

3 Payments to Employees Exempt from FUTA Tax. When you pay SUTA taxes on time and file IRS Form 940 your FUTA tax rate goes down as low as 04. How is the state unemployment tax calculated.

Like other payroll taxes you pay SUTA taxes on a.