While some of these costs are fixed such as the rent of the factory. While some of these costs are fixed such as the rent of the factory.

Finally we get to apply the manufacturing overhead cost formula.

How to find manufacturing overhead. Manufacturing Overhead is a kind of cost that are incurred in the process of manufacturing the product but those costs shall be indirectly associated with the process of manufacturing product. Below given is the formula that is used to calculate manufacturing overhead Manufacturing Overhead Formula Depreciation Expenses on Equipment used in Production Rent of the factory building. How Do You Calculate Allocated Manufacturing Overhead.

Calculate the total manufacturing overhead costs. While some of these costs are fixed such as the rent of the factory. Select an allocation base.

The allocation base is the basis on which a business assigns overhead costs to products. Manufacturing overhead is all indirect costs incurred during the production process. These indirect costs include insurance electricity machine repairs and more.

These expenses are allocated to products so that they properly reflect the full cost of producing the good. Formula to calculate manufacturing overhead. The formula for manufacturing overhead can be derived by using the following steps.

Firstly determine the cost of goods sold which includes all direct and indirect costs of production. Next determine the cost of raw material which includes the cost of raw material purchase. Manufacturing Overhead Example First determine the COGS.

Calculate the direct cost of goods sold. Next determine the cost of raw material. Calculate the cost of raw material.

Next determine the direct labor costs. Calculate the direct labors costs associated with the good. Finally calculate the.

The overhead rate sometimes called the standard overhead rate is the cost a business allocates to production to get a more complete picture of product and service costs. The overhead rate is. Overhead rates refer to that percentage of direct costs that enable assigning overhead costs to the respective cost object.

It is determined on the basis of the causation principle. Overhead rates can be calculated by using the cost allocation method for each cost centre category. Compute the overhead allocation rate by dividing total overhead by the number of direct labor hours.

You know that total overhead is expected to come to 400. Add up the direct labor hours associated with each product 120 hours for Product J 40 hours for Product K 160 total hours. Now plug these numbers into the following equation.

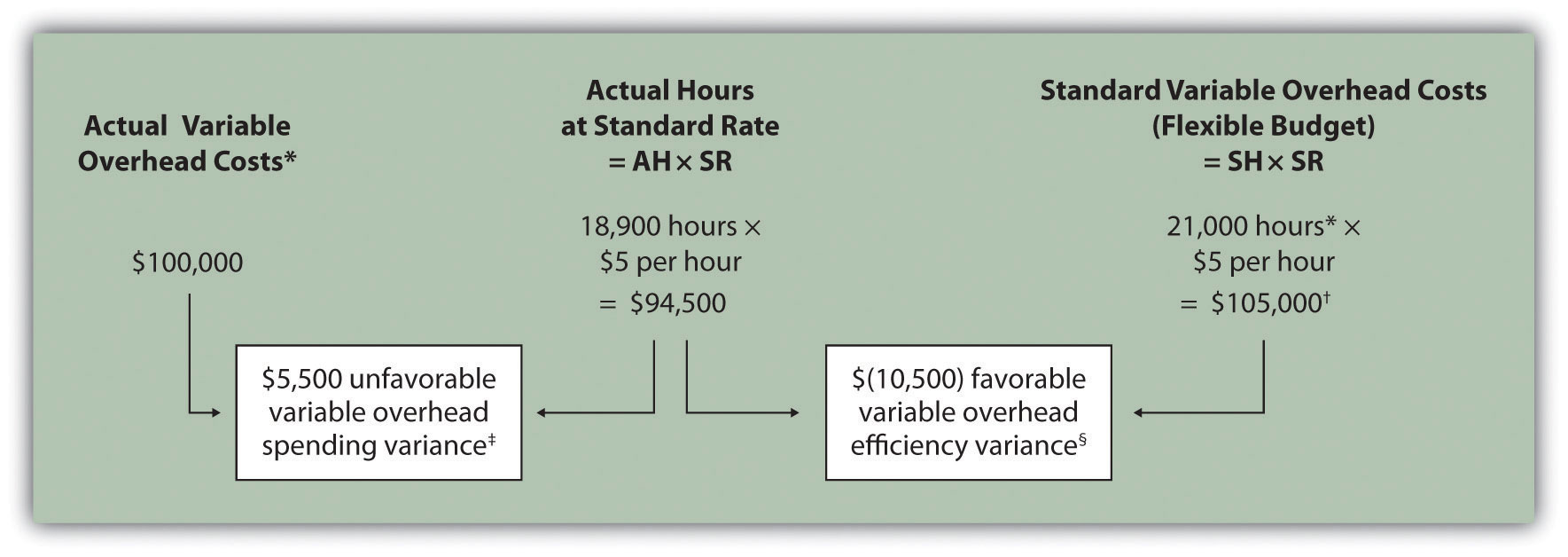

Manufacturing overhead is all indirect costs incurred during the production process. The occurrence of over or under-applied overhead is normal in manufacturing businesses because overhead is applied to work in process using a predetermined overhead rate. A predetermined overhead rate is computed at the beginning of the period using estimated information and is used to apply manufacturing overhead cost throughout the period.

Finally we get to apply the manufacturing overhead cost formula. Manufacturing Overhead Total Indirect Costs Total Units Produced 17650 800 1831 There we have it. Our manufacturing overhead comes to around 18 dollars per skateboard.

The estimated amount of overhead costs are the costs that cannot be allocated specifically to any of the product department or object are to be applied to different jobs The base units estimated activity is the basis on which the companys overhead is to be applied. To find the manufacturing overhead per unit In order to know the manufacturing overhead cost to make one unit divide the total manufacturing overhead by the number of units produced. The total manufacturing overhead of 50000 divided by 10000 units produced is 5.

To do this simply take the monthly manufacturing overhead and divide it by monthly sales then multiply the total by 100. For example you recently determined that your company had monthly. Manufacturing overhead is any cost not directly related to a facilitys production.

The indirect costs in manufacturing overhead can also be called factory overhead production overhead or factory burden. Direct costs like the price of material and labor are directly related to a facilitys manufacturing efforts and therefore arent. The best way to budget for manufacturing overhead is to set aside the amount of money needed to cover all overhead costs.

The amount should be equal to the overhead percentage calculated from your costs divided by your monthly revenue. Just remember that manufacturing costs as well as sales can vary from month to month. This video shows how to prepare a Manufacturing Overhead Budget.

Manufacturing companies create a Manufacturing Overhead Budget so they know how much manufa.