General and administrative expenses. Depreciation cannot be considered a variable cost since it does not vary with activity volume.

The treatment of depreciation as an indirect cost is the most common treatment within a business.

Is depreciation a period cost. Depreciation is a fixed cost because it recurs in the same amount per period throughout the useful life of an asset. Depreciation cannot be considered a variable cost since it does not vary with activity volume. Depreciation is a fixed cost because it recurs in the same amount per period throughout the useful life of an asset.

Depreciation cannot be considered a variable cost since it does not vary with activity volume. However there is an exception. Depreciation is an accounting method of allocating the cost of a tangible or physical asset over its useful life or life expectancy.

Depreciation represents how much of an assets value has been. In the production department of a manufacturing company depreciation expense is considered an indirect cost since it is included in factory overhead and then allocated to the units manufactured during a reporting period. The treatment of depreciation as an indirect cost is the most common treatment within a business.

As shown in the income statement above salaries and benefits rent and overhead depreciation and amortization and interest are all period costs that are expensed in the period incurred. On the other hand costs of goods sold related to product costs are expensed on the income statement when the inventory is sold. Other examples of period costs include marketing expenses rent not directly tied to a production facility office depreciation and indirect labor.

Also interest expense on a companys debt. The depreciation on the trucks used to deliver products to customers is a period cost. The depreciation on delivery trucks will be reported as an expense on the income statement in the period in which it occurs.

It might be reported as part of Selling Expenses or as part of Selling General and Administrative SGA Expenses. The depreciation on the trucks used to transport materials or work-in-process between the facilities of a manufacturer is a component of manufacturing overhead. Depreciation of office computers A period cost is a cost that is considered as an expense immediately.

It is normally shown in the income statement and the items are not related to. Depreciation is a period cost and not a product cost as depreciation is still charged even if there is no production or sale of goods. Is depreciation of delivery truck a period cost.

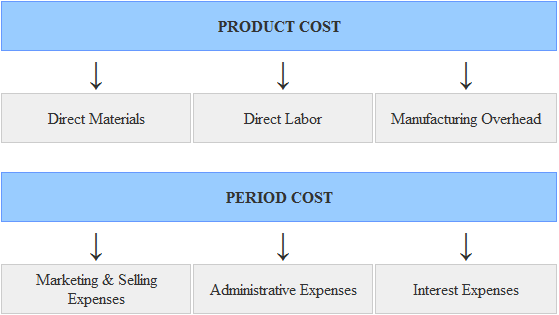

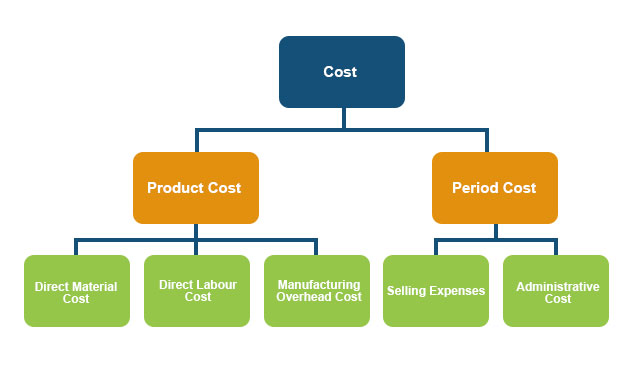

Costs may be classified as product costs and period costs. This classification is usually used for financial accounting purposes. A brief explanation of product costs and period costs is given below.

Product costs also known as inventoriable costs are those costs that are incurred to acquire or manufacture a product. For a manufacturing. 49 The depreciation charge for a period is usually recognised in profit or loss.

However sometimes the future economic benefits embodied in an asset are absorbed in producing other assets. In this case the depreciation charge constitutes part of the cost of the other asset and is included in its carrying amount. For example the depreciation of manufacturing plant and equipment is included.

Depreciation is a term used in accounting to describe the cost of using an asset over a period of time when its useful to your business. How do you calculate depreciation in the UK. There are two different ways you can calculate depreciation in the UK.

1 Straight line depreciation. Depreciation is a cost to the business but it cannot be treated like an expense where 100 of the amount can be offset against that years revenue. Instead the value of the item or cost is offset over a few years depending on certain accounting rules.

Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset. Depreciation is a process of deducting the cost of an asset over its useful life. Assets are sorted into different classes and each has its own useful life.

In a broader economic sense the depreciated cost is the aggregate amount of capital that is used up in a given period such as a fiscal year. The depreciated cost can be examined for trends in a. Depreciation cost is the amount of a fixed asset that has been charged to expense through a periodic depreciation charge.

Travel and entertainment expenses. Depreciation is a period cost and not a product cost as depreciation is still charged even if there is no production or sale of goods. General and administrative expenses.