You continue to live in your home and retain title to it. You must be at least 62 or the youngest person in a couple must be this age in order to get a reverse mortgage through the FHA program.

You could access up to 55 of the equity from your home tax-free without having to make monthly mortgage payments with no negative cash flow impact.

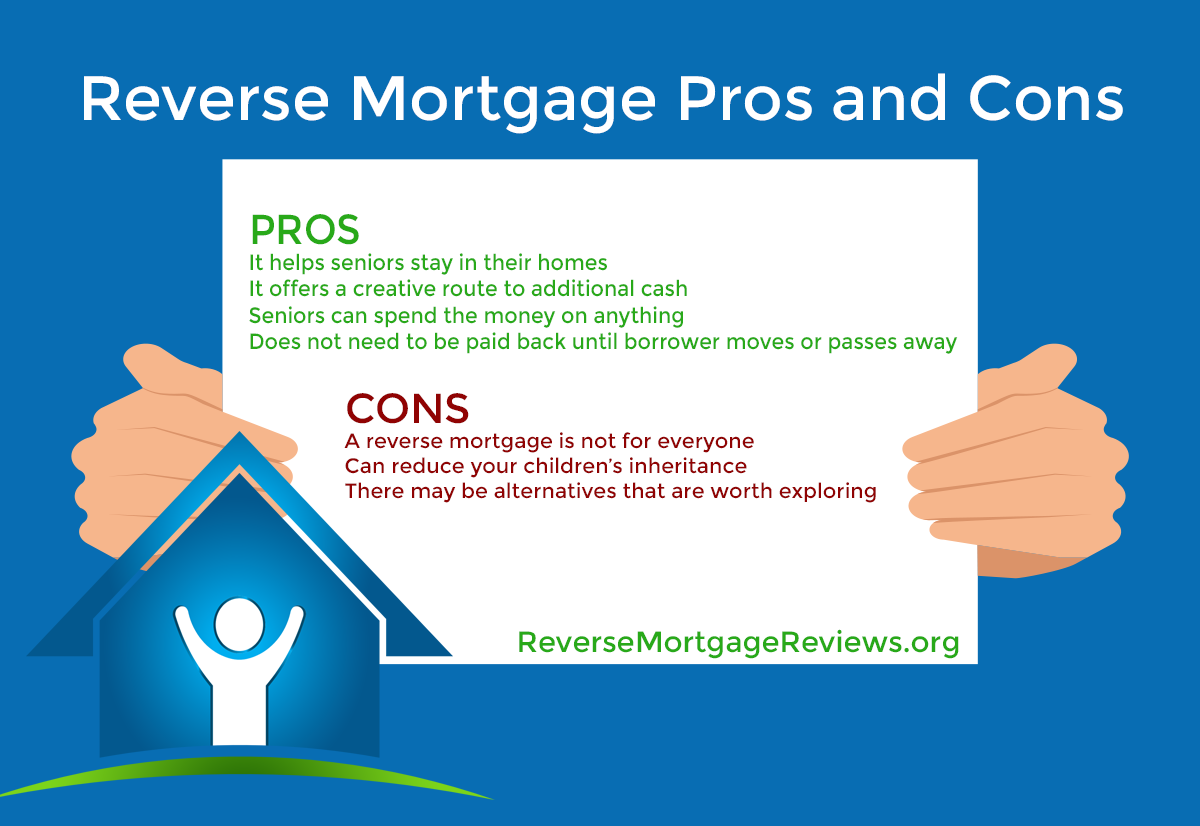

Pros and cons of reverse mortgage. Reverse mortgage pros You can better manage expenses in retirement Many seniors experience a significant income reduction when they retire and monthly mortgage payments can be their biggest. Cons of reverse mortgages You could default and potentially lose your home if you dont meet certain requirements With a reverse mortgage you default when you fail to meet the ongoing. Cons of Reverse Mortgages Value of estate inheritance may decrease over time as proceeds are spent and interest accrues on the loan balance Fees are typically higher than with a traditional mortgage such as the following.

Upfront Mortgage Insurance Premium UFMIP. The Pros and Cons of a Reverse Mortgage A reverse mortgage can be a valuable retirement planning tool that can greatly increase retirees income streams by using their largest assets. A reverse mortgage allows homeowners to borrow against their homes equity while still maintaining ownership of the home.

PROS of a reverse mortgage. Its a loan option that can help make it easier for homeowners and homebuyers age 62 and older to live a more comfortable retirement. You continue to live in your home and retain title to it.

As with any mortgage you must meet your loan obligations keep current with property taxes insurance maintenance and any homeowners association fees. Reverse Mortgage Pros and Cons by ARLO 2021 1. Reverse mortgages can have higher closing costs vs traditional mortgages.

Reverse mortgages can be expensive loans due to upfront financed. May impact needs based programs. Beware of bad actors.

Older versions lacked spousal protection. Reverse mortgages are one option for seniors to unlock the value in their home equity. Before discussing this option with your family its critical to understand the reverse mortgage pros and cons.

Borrowers are effectively accruing compounding interest on their cost of living and at a higher rate than fixed rates meaning they are leaving less value for their children when. Reverse Mortgage Pros and Cons. Like every form of home financing there are pros and cons to each.

For many a reverse mortgage is a huge lifeline and well suited to their particular situation. Pros and Cons of Reverse Mortgages They are a steady stream of income that lasts for years. You can convert the equity in your home into a pile of cash without having to move out.

The money is tax free. Reverse Mortgage Cons Because reverse mortgages are designed with many beneficial features including no monthly mortgage payment and government insurance senior homeowners are keenly attracted to them. However like all financial products there are aspects of this loan that may not best serve your specific situation.

You must be at least 62 or the youngest person in a couple must be this age in order to get a reverse mortgage through the FHA program. There are several costs to getting a reverse mortgage including mortgage insurance. Your heirs may not be able to keep the home if they cant afford to pay off the loan.

Reverse mortgages allow homeowners age 62 and older to access their home equity to generate income in older age. While a reverse mortgage may be ideal for some situations it is not always best for. Pros and cons of a reverse mortgage.

A reverse mortgage is an excellent idea for some people – but not everyone. Here are the pros and cons of getting a reverse mortgage. In many ways a reverse mortgage is similar to a conventional mortgage only backwards.

With a conventional loan you borrow money from a lender and make payments with interest until everythings paid back in full. With a reverse mortgage the lender makes payments to you based on the equity you hold in your home. Pros of reverse mortgages.

You could access up to 55 of the equity from your home tax-free without having to make monthly mortgage payments with no negative cash flow impact. It allows you to leverage your most valuable asset. But with a reverse mortgage the lender pays you.

For many people a reverse mortgage can be a very appealing source of retirement income. But there are drawbacks as well as benefits. Below are the Pros and Cons of a Reverse Mortgage.

PROS of a Reverse Mortgage.