No monthly mortgage payments are required however the homeowner must live in the home as their primary residence continue to pay required property taxes homeowners insurance and maintain the home according to Federal Housing Administration requirements. Dummies has always stood for taking on complex concepts and making them easy to understand.

A reverse mortgage is a type of mortgage loan thats secured against a residential property that can give retirees added income by giving them access to the unencumbered value of their properties.

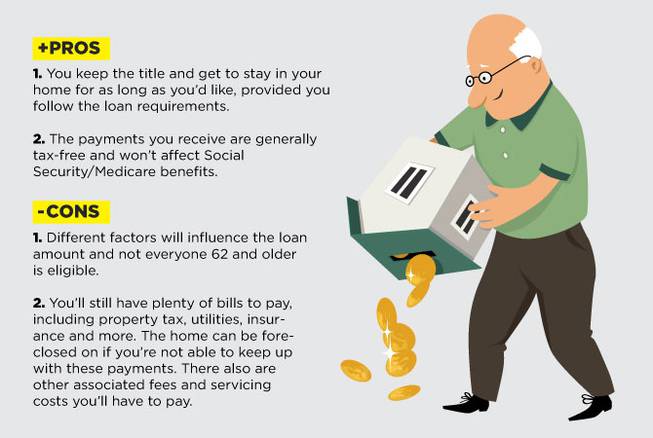

Reverse mortgages pros and cons. Pros and Cons Reverse mortgages can be a good way to shore up retirement income but costs can outweigh benefits for some. Claire Tsosie July 21 2020. Reverse mortgage cons You have to pay for it.

Reverse mortgages have costs that include lender fees FHA insurance charges and closing costs. These costs can be added to the loan balance. Cons of Reverse Mortgages Value of estate inheritance may decrease over time as proceeds are spent and interest accrues on the loan balance Fees are typically higher than with a traditional mortgage such as the following.

Requirements of a Reverse Mortgage. A reverse mortgage is generally a type of FHA loan called a HECM loan While some lenders offer proprietary or non-FHA insured reverse mortgages most of these loans are offered by lenders who use the HECM program through the FHA. When considering a reverse mortgage consider focusing on programs that are FHA-insured and must adhere to federal guidelines.

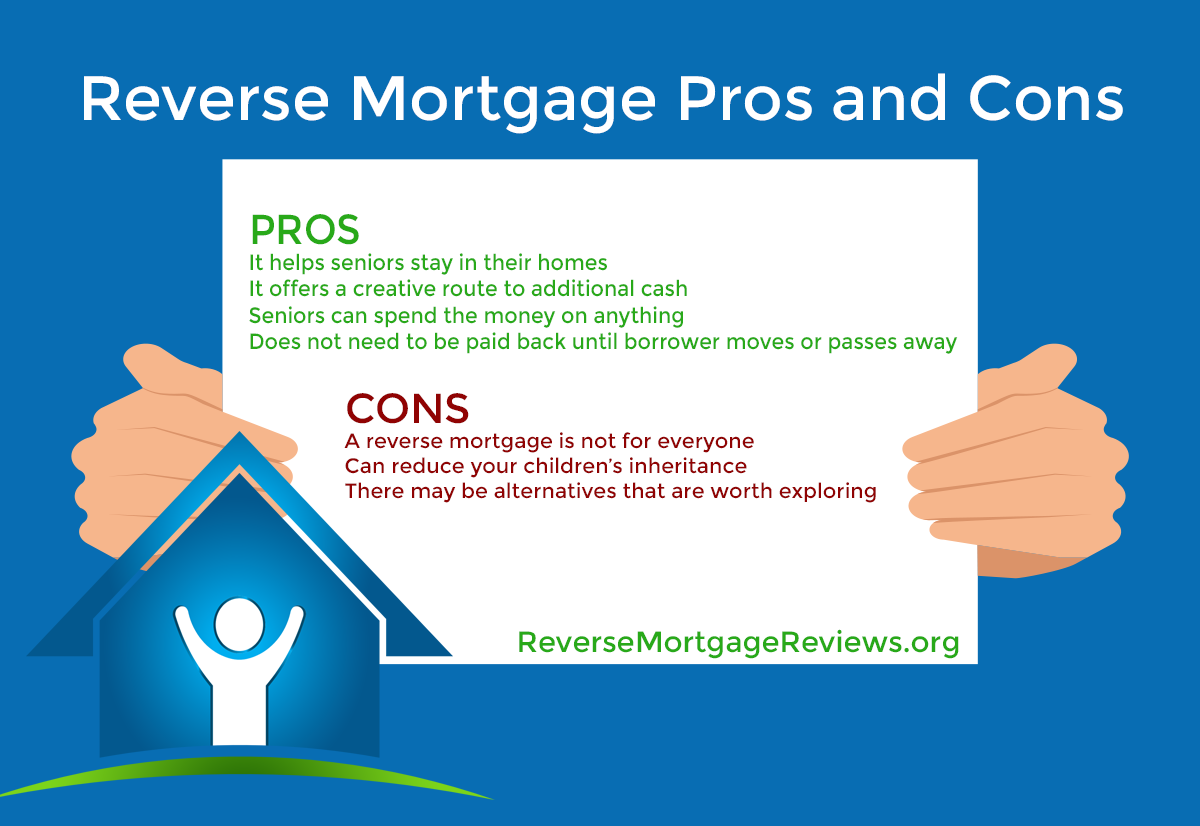

We have published our reverse mortgage pros and cons guide to help you make an informed decision about reverse mortgages and help you raise a few questions to determine if the program is suitable for your long-term retirement goals. Reverse mortgages are one option for seniors to unlock the value in their home equity. Before discussing this option with your family its critical to understand the reverse mortgage pros and cons.

Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Pros and Cons of Reverse Mortgages.

They are a steady stream of income that lasts for years. You can convert the equity in your home into a pile of cash without having to move out. The money is tax free.

Rather than income earned a reverse mortgage is considered a loan so the IRS cant get its sticky fingers on it. And a reverse mortgage. The pros of a reverse mortgage include.

You can spend the money how you like. Pay down debt or fund home improvements travel medical treatment or even use it for general living expenses. REVERSE MORTGAGE PROS AND CONS.

A reverse mortgage could be a key component to your retirement planning providing funds now and for the future but its not the right choice for everyone. We want you to understand the advantages and disadvantages to help you determine if a reverse mortgage is right for you. Reverse mortgages have skyrocketed in popularity among cash-strapped seniors.

But carefully weigh the pros and cons and alternatives before taking this unique type of loan. Pros and cons of a reverse mortgage. A reverse mortgage is an excellent idea for some people – but not everyone.

Here are the pros and cons of getting a reverse mortgage. Pros and Cons of Reverse Mortgages Reverse mortgages may seem like an easy way to get the money you need but there are quite a few downsides associated with this kind of loan. You should always speak with a financial advisor before deciding to take out a reverse mortgage.

A reverse mortgage is a type of mortgage loan thats secured against a residential property that can give retirees added income by giving them access to the unencumbered value of their properties. Pros of Reverse Mortgages. Allows the homeowner to stay in the home.

1 Can pay off existing mortgages on the home. No monthly mortgage payments are required however the homeowner must live in the home as their primary residence continue to pay required property taxes homeowners insurance and maintain the home according to Federal Housing Administration requirements. A reverse mortgage is becoming an increasingly popular option for many Canadians aged 55 or over.

Here well take a look at the pros cons and common misconceptions of reverse mortgages to help you see if this financial solution is right for you. Pros of reverse mortgages. To learn more about the details of the pros and cons of reverse mortgages speak with a reverse mortgage professional from American Advisors Group at 1-888-998-3147 or click here to request a free reverse mortgage info kit.

All consultations are free and can provide a wealth of information to help determine if a reverse mortgage loan can be. Pros and cons of a reverse mortgage. Before you decide to get a reverse mortgage make sure you consider the pros and cons carefully.

You dont have to make any regular loan payments. You may turn some of the value of your home into cash without having to sell it.