If it becomes necessary the Roth IRA allows you to withdraw contributions that is the money you put into the account without being taxed or penalized. By Martha Maeda Feb 1 2011.

I like Roth IRAs better.

Roth iras for dummies. You can stop looking. A Roth IRA is an individual retirement account in which money grows tax-free and retirement withdrawals are tax-free. In 2020 the contribution limit is up to 6000 7000 if 50 or older for.

A Roth IRA allows greater flexibility as you can invest in whatever you want. You can withdraw Roth IRA contributions at any time tax and penalty-free. Roth IRA earnings can go towards the purchase of your first home.

Now there are some benefits to the 401k as well. A 401k is something offered by your employer. There is an income threshold on the Roth IRA.

If you make too much money you cant play the Roth game. You start losing the ability to contribute to a Roth IRA if your income is over 125000 and youre single or over 183000 if youre married and filing a joint tax return. There is no age limit with the Roth IRA.

The annual Roth IRA contribution limit for 2020 and 2021 is 6000 or your total annual salary whichever is smaller. Those 50 and older can make an additional 1000 in catch-up contributions. Worry not friend included in our explanation of a Roth IRA for dummies is help selecting good stocks to invest in new window.

Assuming you follow our rules and make good choices your account will begin growing. Anything that you have in your Roth IRA that isnt a contribution is earnings. The earnings must stay in your Roth IRA until youre 59 12 or you get taxed and penalized.

How Much Can You Put into a Roth IRA. For 2020 the maximum contribution to a Roth IRA is 6000 per yearBut if youre 50 or older that increases to 7000 per year. There is a bit of a.

Roth IRA early withdrawal rules are more flexible. Early withdrawal rules are far more flexible with a Roth IRA but in a perfect world early withdrawals would not be necessary. If it becomes necessary the Roth IRA allows you to withdraw contributions that is the money you put into the account without being taxed or penalized.

The Roth IRA is an individual retirement account that provides tax-free growth and withdrawals to participants who pay taxes on their contributions. While it can help anyone save more money for. A Roth IRA is a retirement savings account that allows you to withdraw your money tax-free.

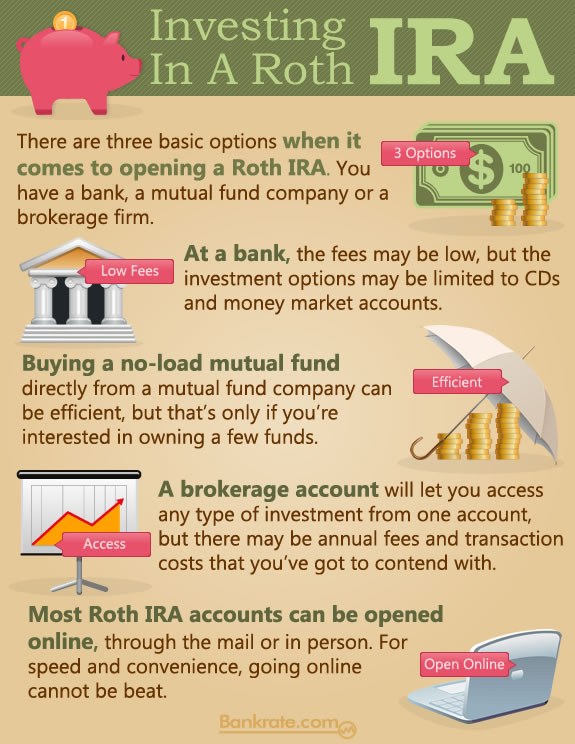

Learn why a Roth IRA may be a better choice than a traditional IRA for some retirement savers. Unlike 401 ks which are accounts provided by your company the most common types of IRAs are accounts that you open on your own. Others can be opened by self-employed individuals and small.

If you have been thinking about a Roth IRA for your retirement investments in 2019 then this is your video. Today we will cover all the very basics of the Ro. A Roth IRA conversion made in 2017 may be recharacterized as a contribution to a traditional IRA if the recharacterization is made by October 15 2018.

A Roth IRA conversion made on or after January 1 2018 cannot be recharacterized. There are income limitations to open a Roth IRA account. If you file as a single person and your Modified Adjusted Gross income MAGI is above 139000 for tax year 2020 and 140000 for tax year 2021 or if you file jointly and you have a combined MAGI above 206000 for tax year 2020 and 208000 for tax year 2021 you may not be eligible to.

A Roth IRA lets you put money away for retirement but you dont get a tax deduction for the money you put in. 1000 into a Roth IRA gives you no tax savings. There are income limits for contributing to a Roth the phase out starts at 167000.

If youre under that income level youre fine. 1-16 of 148 results for ira for dummies Skip to main search results Eligible for Free Shipping. Free Shipping by Amazon.

Retire Rich With Your Roth IRA Roth 401k and Roth 403b Investment Strategies for Your Roth IRA Explained Simply. By Martha Maeda Feb 1 2011. 43 out of 5 stars 7.

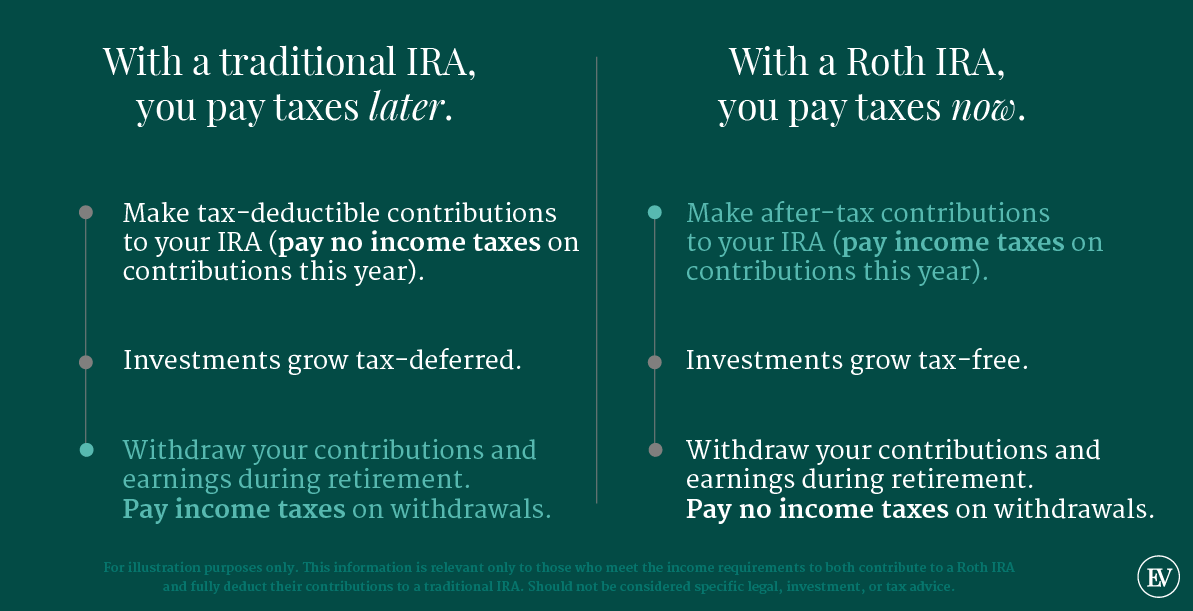

The biggest difference between the two is taxation. Traditional IRA vs Roth IRA new window How to start a Roth IRA in 6 easy steps. I like Roth IRAs better.

The taxation is awesome especially for young people. Quick summary of what it means to say Roth IRA new window. A Roth IRA is an Individual Retirement Account.

Its used for retirement savings and can only be withdrawn after youve reached a certain age. With a Roth IRA you are contributing money that has already been taxed in your paycheckSo you will not be taxed again when you take the funds out. All investment gains are tax-free too.

Of course there are certain rules that must be followed. The tax rules for a Roth and a Traditional IRA are different. The Roth IRA is funded with money youve earned and already payed taxes on and the withdrawals including gifting are tax free.

The traditional IRA is funded with pre-tax dollars so you still have to pay taxes on withdrawals which includes gifting.