Diversification– Each index fund represents an interest in an underlying basket of securities. How Does a Hedge Fund Work.

Index funds are a popular way to participate in the stock market and diversify a portfolio.

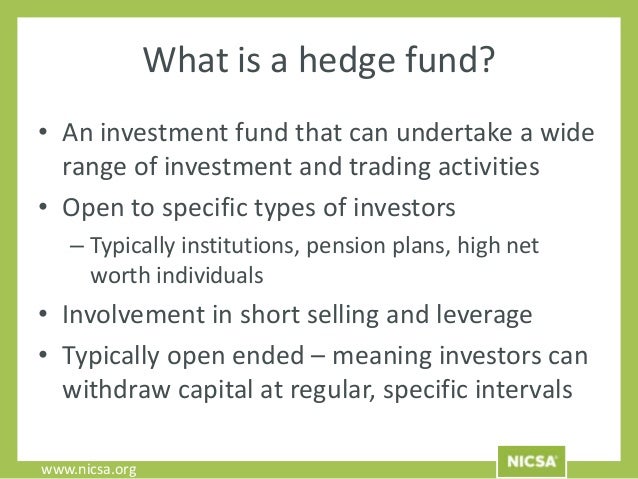

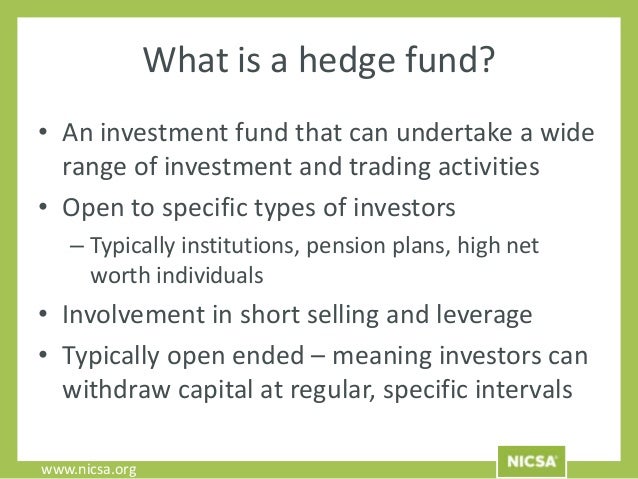

Simple definition of hedge fund. A hedge fund is a type of investment vehicle that caters to high-net-worth individuals institutional investors and other accredited investors. A hedge fund is just a fancy name for an investment partnership that has freer rein to invest aggressively and in a wider variety of financial products than most mutual funds. Its the marriage of.

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading portfolio-construction and risk management techniques in an attempt to improve performance such as short selling leverage and derivatives. Financial regulators generally restrict hedge fund marketing except to institutional investors high net worth. Hedge Fund Definition A simple hedge fund definition is.

A hedge fund is an alternative investment that is designed to protect investment portfolios from market uncertainty while generating positive returns in both up and down markets. Throughout time investors have looked for ways to maximize profits while minimizing risk. A hedge fund HF is a type of alternative investment that seeks to generate high returns by investing in a pool of underlying securities.

In other words its a group of investors funds pooled together to purchase investments. Definition of a Hedge Fund When planning for our future common advice is to invest particularly in mutual funds. Mutual funds are very attractive for an individual.

They diversify your portfolio. A hedge fund is a pooled investment structure set up by a money manager or registered investment advisor and designed to make a return. This pooled structure is often organized as either a limited partnership or a limited liability company.

A hedge fund isnt a specific type of investment but rather a vehicle for investment. A hedge fund is a special type of managed fund. A hedge fund can use more than one type of investment strategy to generate returns.

They often have higher fees. What is a Hedge Fund. A hedge fund is an investment structure designed to allow management of a private unregistered portfolio of assets.

How Does a Hedge Fund Work. The original concept of a hedge fund was to offer plays against the market using short selling futures and derivatives. Whats the definition of a hedge fund.

Well simply put a hedge fund is nothing more than an investment company that invests its clients money in alternative investments to either beat the market. A Hedge Fund is a generic name for a pool of funds invested in a particular approach in a number of financial products and markets with the only aim of making an absolute return. A hedge is an investment that protects your finances from a risky situation.

Hedging is done to minimize or offset the chance that your assets will lose value. It also limits your loss to a known amount if the asset does lose value. Its similar to home insurance.

Definition of hedge fund. An investing group usually in the form of a limited partnership that employs speculative techniques in the hope of obtaining large capital gains Examples of hedge fund in a Sentence. Hedge fund can be defined as a managed portfolio that has targeted a specific return goal regardless of market conditions.

Hedge funds specialize in gaining maximum returns for minimum risk. Hedge funds use a wide variety of different investing strategies to achieve this goal and generally these strategies are managed and executed by a. From Simple English Wikipedia the free encyclopedia A mutual fund is a kind of investment that uses money from investors to invest in stocks bonds or other types of investment.

A fund manager or portfolio manager decides how to invest the money and for this he is paid a fee which comes from the money in the fund. In this practice note Neil Simmonds a partner in the Financial Services group at Simmons Simmons LLP and Martin Shah a partner in the firms Corporate Tax group provide an overview of the permissible structures for UK investment funds. This includes discussion of collective investment schemes CIS authorised and unauthorised unit trusts open-ended investment companies OEICs.

Index funds are a popular way to participate in the stock market and diversify a portfolio. Index funds have several major advantages over direct ownership of the underlying securities. Heres a brief review.

Diversification– Each index fund represents an interest in an underlying basket of securities. Exchange-Traded Funds - They look feel and trade like stocks. And like a stock the price of an ETF changes throughout the day.