Profitability is composed of cash earned but also of non-cash items. Qualify for that big promotion or even master that cooking technique.

To prepare a statement of cash flows find out how much money the company had last year by checking the prior years ending balance sheet.

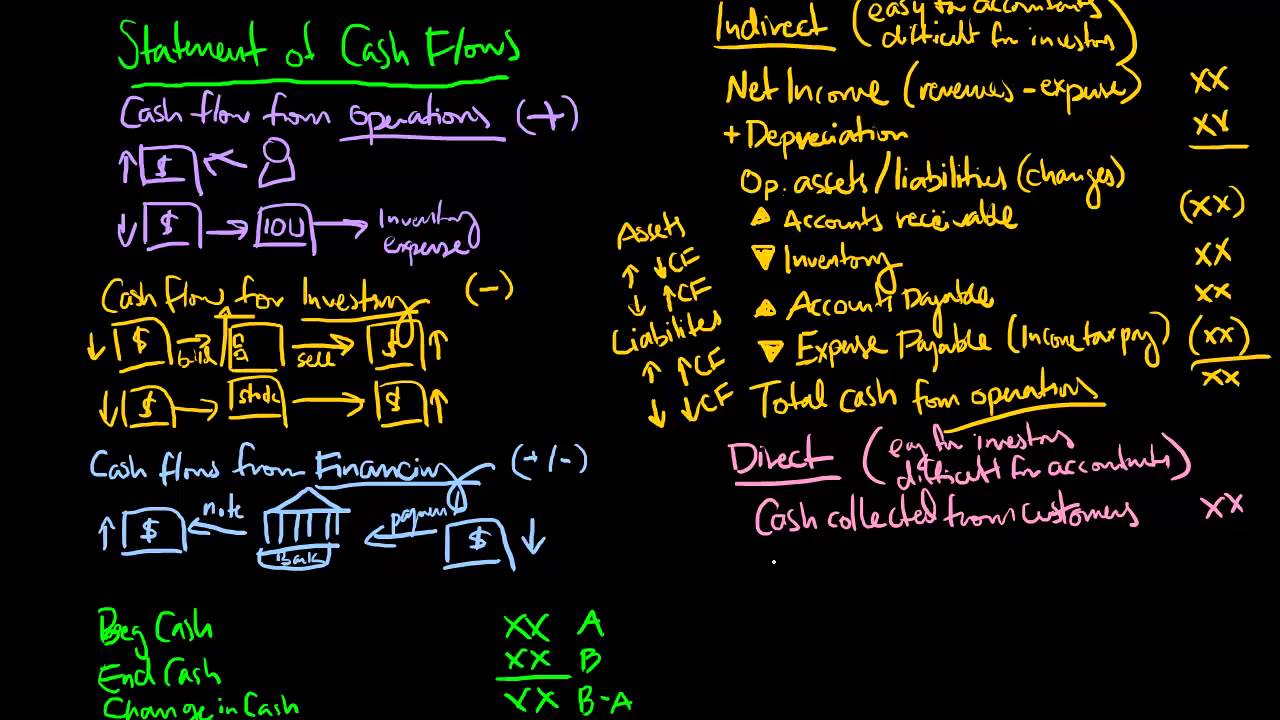

Statement of cash flows for dummies. The direct method of preparing the statement of cash flows shows the net cash from operating activities. This section shows all operating cash receipts and payments. Some examples of cash receipts you use for the direct method are cash collected from customers as well as interest and dividends the company receives.

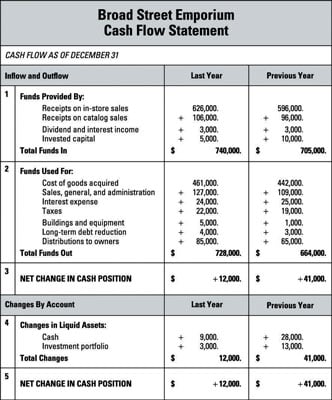

A cash-flow statement is important for your business planning because it tells you how money flowed in and out of your business over a certain time period and how assets of your business changed as a result. Cash-flow statements also offer a great way to forecast and plan before plugging numbers into your income statement or balance sheet. Get an overview of the statement of cash flows which show cash sources and uses during a specific period of time.

Qualify for that big promotion or even master that cooking technique. People who rely on dummies rely on it to learn the critical skills and relevant information. The statement of cash flows documents a firms sources and uses of cash for a particular period of time such as a month or year.

The statement separates cash flows into three activities. Activities on the Statement of Cash Flows. The cash flow statement CFS measures how well a company manages its cash position meaning how well the company generates cash to pay its debt obligations and fund its operating expenses.

When preparing the statement of cash flows using the indirect method the operating section starts with net income from the income statement which you adjust for any noncash items hitting the income statement. Your three biggies are depreciation amortization both of which are noncash transactions and gain or loss on the disposal of assets. Cash Flow Statement Example Cash receipts is simply cash collected from customers.

Obviously cash receipts increase the amount of cash the company has on hand and this is reflected on the Cash Flow Statement. Cash disbursements is cash paid out to pay for such things as inventory salary rent etc. The Cash Flow Statement is one of the 3 main Financial Statements.

It will show you how effective a business is in managing its cash. Most companies apply A. Cash flow statements can be presented using either of two methods.

The direct or indirect methodThe direct method is used more outside the US while the indirect method is the preferred method within the US. The format shown below is for the direct methodPlease see our separate tutorial on the indirect cash flow statement method for the format and explanations on how to put this. Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year.

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how money moved in and out of the business. Three Sections of the Statement of Cash Flows. To prepare a statement of cash flows find out how much money the company had last year by checking the prior years ending balance sheet.

Then add the companys net income which is its revenue minus its expenses taxes and the depreciation of its assets. Make sure you include the amount the company owes other and what others owe the company. Explanation of the cash flow statement - its components what they represent and basic ways to analyze the information.

This series was initially develope. Chapter 6 Statement of Cash Flows The Statement of Cash Flows describes the cash inflows and outflows for the firm based upon three categories of activities. Generally include transactions in the normal operations of the firm.

This last tutorial has shown that the cash flow statement is an important one to understand. Companies can sometimes deploy slick accounting maneuvers to pretty up the income statement but the cash flow statement tracks the actual flow of money in and out of the firm so usually reveals the unvarnished truth. Share it with your friends tooIf You Liked it.

Cash flow statement tutorial. How does a cash flow statement work. How do cash balance and cash flow relate to each other.

What is cash flow from operating a. The cash flow statement does not tell us the profit earned or lost during a particular period. Profitability is composed of cash earned but also of non-cash items.

This is true even for items on. The Statement of Cash Flows is explained using the Indirect and Direct methods. The Cash Flow Statement divides into three parts.

Cash Flow Used Provided by Operating Activities these are the cash movements arising from the profit-generating activities of the company. Some experts term those as usual transactions.