Winery Problem platform for discussing Joint Cost Allocations 4. 5000 10000 35000 50000 sq.

5000 10000 35000 50000 sq.

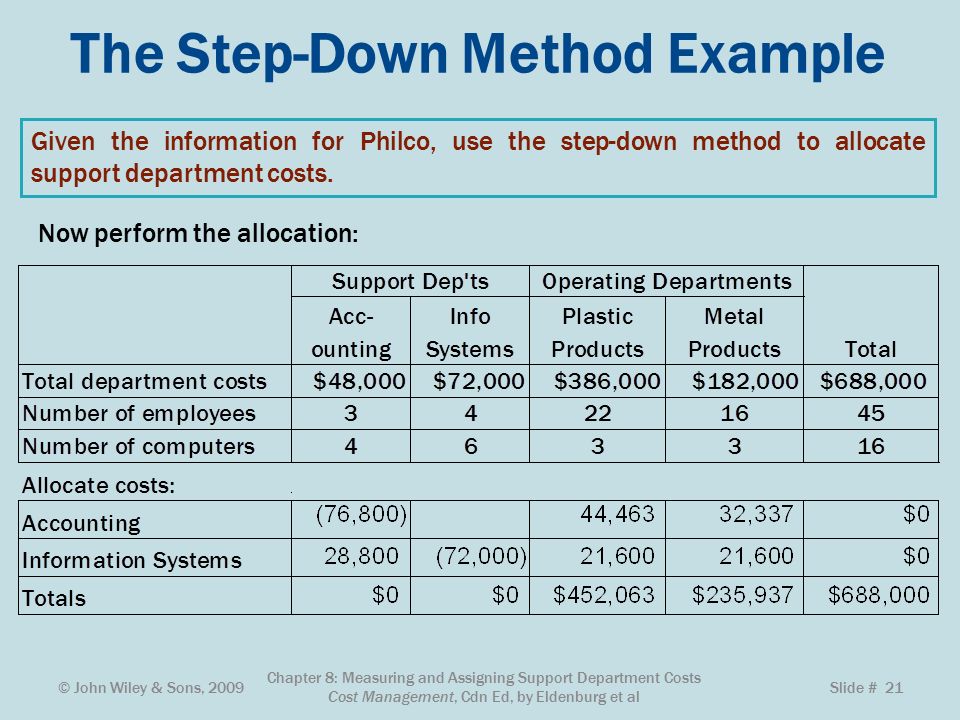

Step down allocation method. Step down method of cost allocation. Unlike direct method the step method also known as step down method allocates the cost of a service department to other service departments as well as to operating departments. The cost allocation under step method is a sequential process.

When cost accounting the step-down allocation method allows support departments to allocate costs to each other and ultimately to the operating departments. To accomplish this the support departments are ranked. The ranking is often based on the percentage of costs that a support department incurs to support other support departments.

Step Method of Allocation. The second method of allocating service department costs is the step method. This method allocates service costs to the operating departments and other service departments in a sequential process.

The sequence of allocation generally starts with the service department that has incurred the greatest costs. The step allocation method is an approach used to allocate the cost of the services provided by one service department to another service department. The essential steps in this allocation process are as follows.

The service department that provides service to the largest number of other service departments or which has the largest percentage of. So allocation on space would work best. The second method is called the step-down method.

This method is more complicated than the direct method as it also takes into account the services that one service department offers another. If the company uses step down method of cost allocation. 42000600 employees 70 per employee 30 120 300 150 600 employees.

072 per sq. 5000 10000 35000 50000 sq. 3000020000 machine hours 12 per hour.

The step-down method or known as sequential method allocates the costs of some service departments to other service departments. However once a service departments costs have been allocated no subsequent costs are allocated back to it. The choice of which department to start with is very important.

Metode step down step down method yang juga disebut metode alokasi step down atau metode alokasi sekuensial step downsequential allocation method yang mengalokasikan biaya departemen pendukung ke departemen pendukung lainnya dan ke departemen operasi secara berurutan sehingga hanya mengakui sebagian jasa bersama yang diberikan di antara. The cost data derived from the step-down method CFOs can use the Medicare cost report step-down method to allocate costs by service line and then develop an income matrix. With an income matrix and tiered expenses by service areas CFOs can direct corrective action to improve financial performance.

The final method is the reciprocal method. Although it is the most accurate it is also the most complicated. In the reciprocal method the relationship between the service departments is recognized.

This means service department costs are allocated to and from the other service departments. Methods of Allocating Costs - Overview 1. Review the three Method of Allocating Costs.

- Direct Method - Step Down Method - Reciprocal Method 2. Discuss the strengths and weaknesses of each method 3. Winery Problem platform for discussing Joint Cost Allocations 4.

Review remaining cost allocation problems. The step-down method of cost allocation allows you to treat it like that even though the money will never leave your organization. The custodial department passes off 20000 in expenses to the.

70 Off the Complete Crash Course on Udemy. Httpbitly2Dhip74In this managerial accounting tutorial we use the step down method to allocate costs from su. The Step-Down or Sequential Method.

The step-down or sequential method ignores self services but allows for a partial recognition of reciprocal services. As a result the step-down method is different from the direct method in that some service department costs are allocated to other service departments. Thus both equations 1 and 2 are.

The step down method of cost allocation. To illustrate how these cost allocations work we will use the following example. An organization manufactures two different products namely product A and product B.

The organization also has an HR department in charge of staff recruitment and a maintenance department in charge of machines and.